Award-winning PDF software

How to prepare Schedule C

About Schedule C

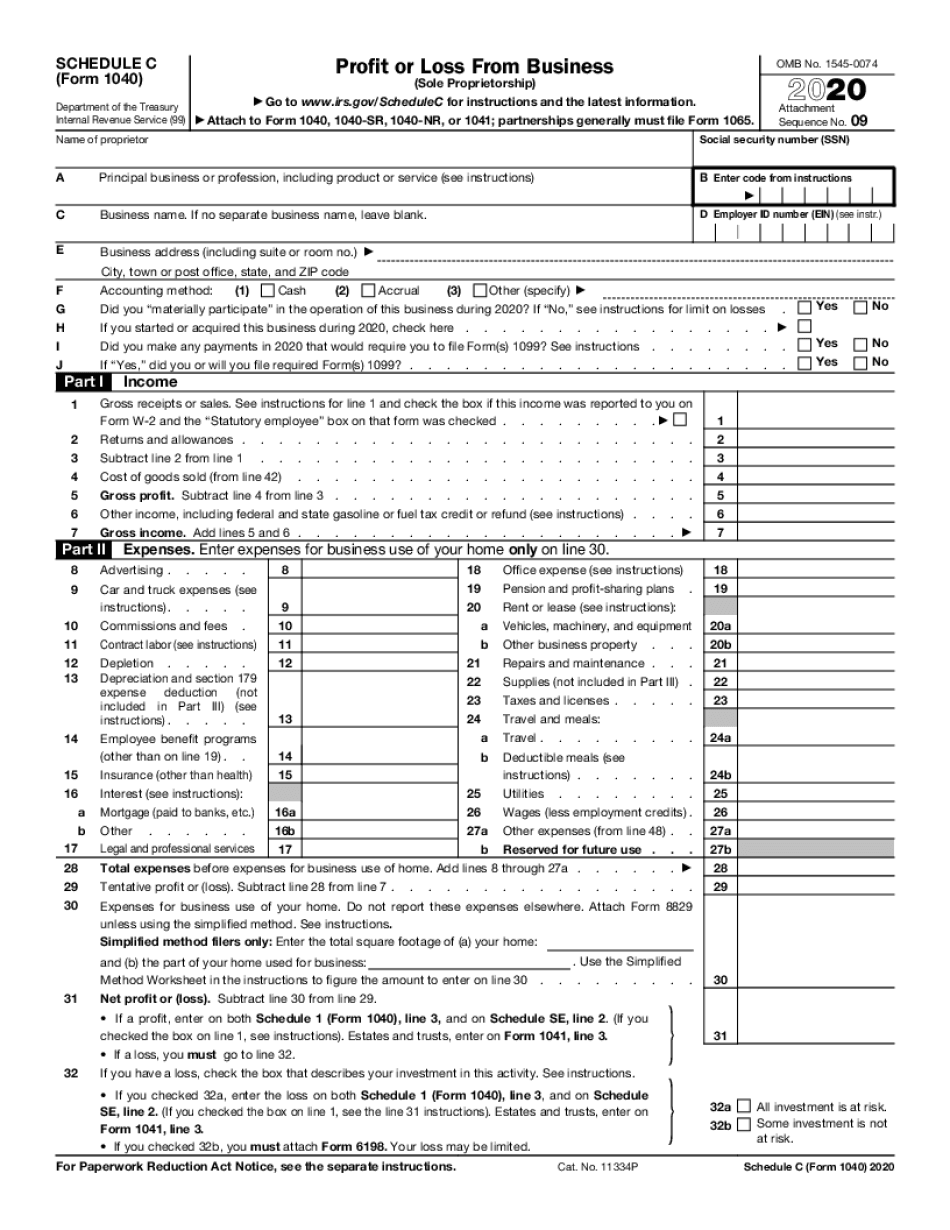

Schedule C is a form used by individuals who operate a business or engage in self-employment. It is a supplemental form attached to the individual's personal tax return (Form 1040) and is used to report the profit or loss from business activities. Individuals who are sole proprietors, freelancers, independent contractors, and small business owners need to file Schedule C along with their personal tax return. This includes individuals who operate businesses as a legal entity (such as a limited liability company or partnership) if the entity is considered a disregarded entity for tax purposes. The Schedule C form allows individuals to report their business income, deductible business expenses, and calculate the net profit or loss from their business activities. The net profit or loss reported on Schedule C is then transferred to the individual's personal tax return and is subject to taxation at the individual's applicable tax rate. It is important for individuals who operate a business or are self-employed to accurately complete Schedule C to ensure compliance with tax regulations and to maximize any available deductions, which can help reduce the overall tax liability.

Get Schedule C and streamline your daily record administration

- Discover Schedule C and start modifying it by simply clicking Get Form.

- Start filling out your form and include the information it needs.

- Take advantage of our extended modifying toolset that permits you to add notes and make comments, if required.

- Review your form and check if the details you filled in is right.

- Swiftly correct any mistake you have when altering your form or come back to the previous version of the file.

- eSign your form easily by drawing, typing, or taking a picture of the signature.

- Save alterations by clicking Done and download or send your form.

- Send your form by email, link-to-fill, fax, or print it.

- Pick Notarize to carry out this task on the form on the internet using our eNotary, if required.

- Safely store your approved file on your PC.

Modifying Schedule C is an easy and intuitive procedure that requires no prior training. Get everything required in a single editor without the need of constantly switching between various platforms. Discover much more forms, complete and preserve them in the file format that you need, and simplify your document administration in a single click. Prior to submitting or delivering your form, double-check details you provided and easily correct errors if required. In case you have questions, contact our Support Team to help you out.